1

Introduction

Background

The Critical Deficit of Transmission Capacity

The group of authors who donated their expertise (and time!) to this book came together for a simple and collective intent: to address the critical deficit of transmission capacity in Sub-Saharan Africa. It is stated that roughly half the population of Sub-Saharan Africa (or 600 million people) lack reliable access to electricity. The lack of electricity access is particularly stark at a time when the global number of persons without access to electricity is falling.

While there is no adequate information on the breakdown between generation, transmission, and distribution, historically investment in generation has been roughly four times higher than transmission and distribution combined. Furthermore, the distribution sector has also attracted more investment than transmission, leaving this segment of the African energy market as the most impacted by a lack of both public and private investment.

The critical nature of transmission infrastructure to the overall function of an energy market cannot be overstated. As generation expands, transmission is needed to bring electricity to the demand centres. Additional transmission capacity (including cross-border) can also provide access to large power generation sources and connect them to unserved demand. Transmission across national borders, often referred to as interconnection, enables economies of scale that bring down the cost of power and allow for greater efficiency in matching production with consumption.

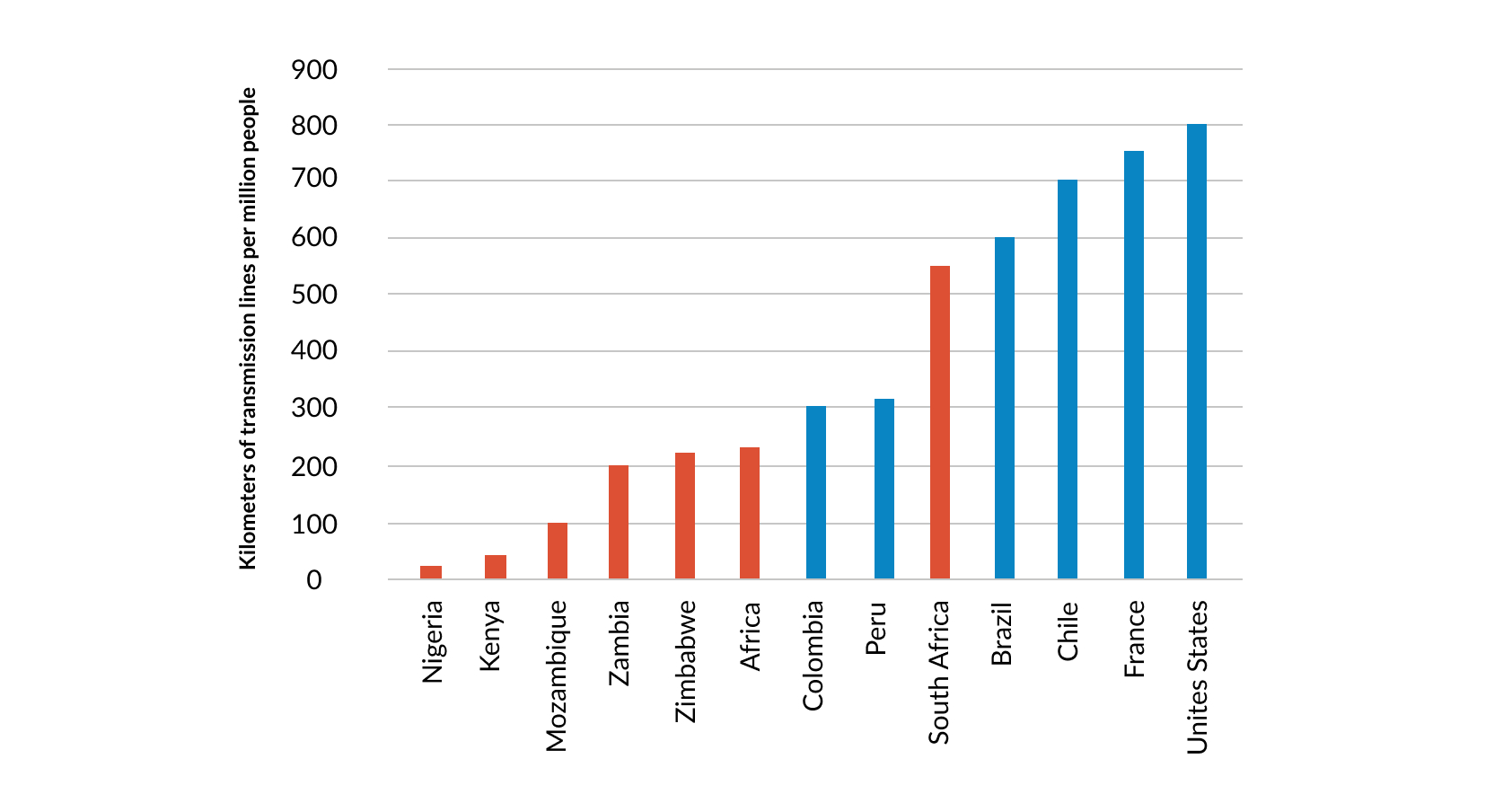

Current estimates place the total investment requirements for the period 2014-2040 at $80-$140 billion, which equates to $3.2–$5.4 billion per year. Of the 38 Sub-Saharan African countries, 9 have no transmission lines above 100 kilovolts (kV). The scale of the transmission deficit is also significant when one considers that the combined length of transmission in the 38 Sub-Saharan African countries is about 112,196 km, less than the length of the domestic transmission network of Brazil. The following Figure 1.1 helps further illustrate the transmission deficit in Sub-Saharan Africa as compared to energy markets around the world.

At a time when the world is coming together to address the threat of climate change, it is also important to note that transmission infrastructure is essential to the transition towards a less carbon-intensive power market. Without it, many grid-connected utility-scale renewable energy projects cannot be implemented. More importantly, developing and maintaining highly optimised transmission systems that can manage the intermittent nature of renewable energy helps to reduce technical losses and avoid the need to build additional generation or storage capacity.

The critical lack of development of transmission infrastructure in Sub-Saharan Africa, despite the increased investment in other segments of the power value chain, naturally leads to two important questions: How did the situation become so dire? and how can we overcome the transmission deficit to widen the access to energy? The first question demands an intense inquiry into economics, politics, sociology and geography that is beyond the capacity of the authors of this handbook. The second question, however, can be answered constructively and is the focus of this book.

The Need for Private Sector Investment

Virtually all development of transmission infrastructure in Sub-Saharan Africa remains within the responsibility of fully or partially state-owned utilities. One reason is that it is difficult to prioritise and justify transmission projects when transmission costs are not clear and transparently allocated within the sector. As a result, the utilities that currently manage transmission infrastructure often require public subsidies to counter operating losses that arise when costs are not properly allocated and recouped. These subsidies usually take the form of direct budget support from the government. The effect is that state-owned utilities are not incentivised or able to invest in new projects.

This vicious circle of generating losses and failing to invest in new infrastructure is not inevitable. There are numerous examples around the world where energy markets have been able to overcome this transmission deficit through a combination of concerted regulatory reform and partnership with the private sector. This book presents these examples as case studies distributed throughout the chapters. The common narrative across the experiences from other markets is as follows: if the existing market actors (government, utility, regulator) can bring clarity and predictability to the transmission sector, the private sector can deploy its expertise and capital to overcome the infrastructure gap.

It is important to note at the outset of this book that the primary constraint on private investment is not the lack of the availability of capital (see chapter 2. Financing Structures and Capital Sources). The key constraint is, rather, the ability to access that funding through market regulations and project structures that provide the predictable operating conditions and revenue that are fundamental to any commercial investment. This book is intended to outline how public officials can satisfy these expectations from the private sector through a general description of transmission sector regulation, planning and operation, and a detailed explanation of the structures for private investment in the transmission sector.

Private partners, not funders

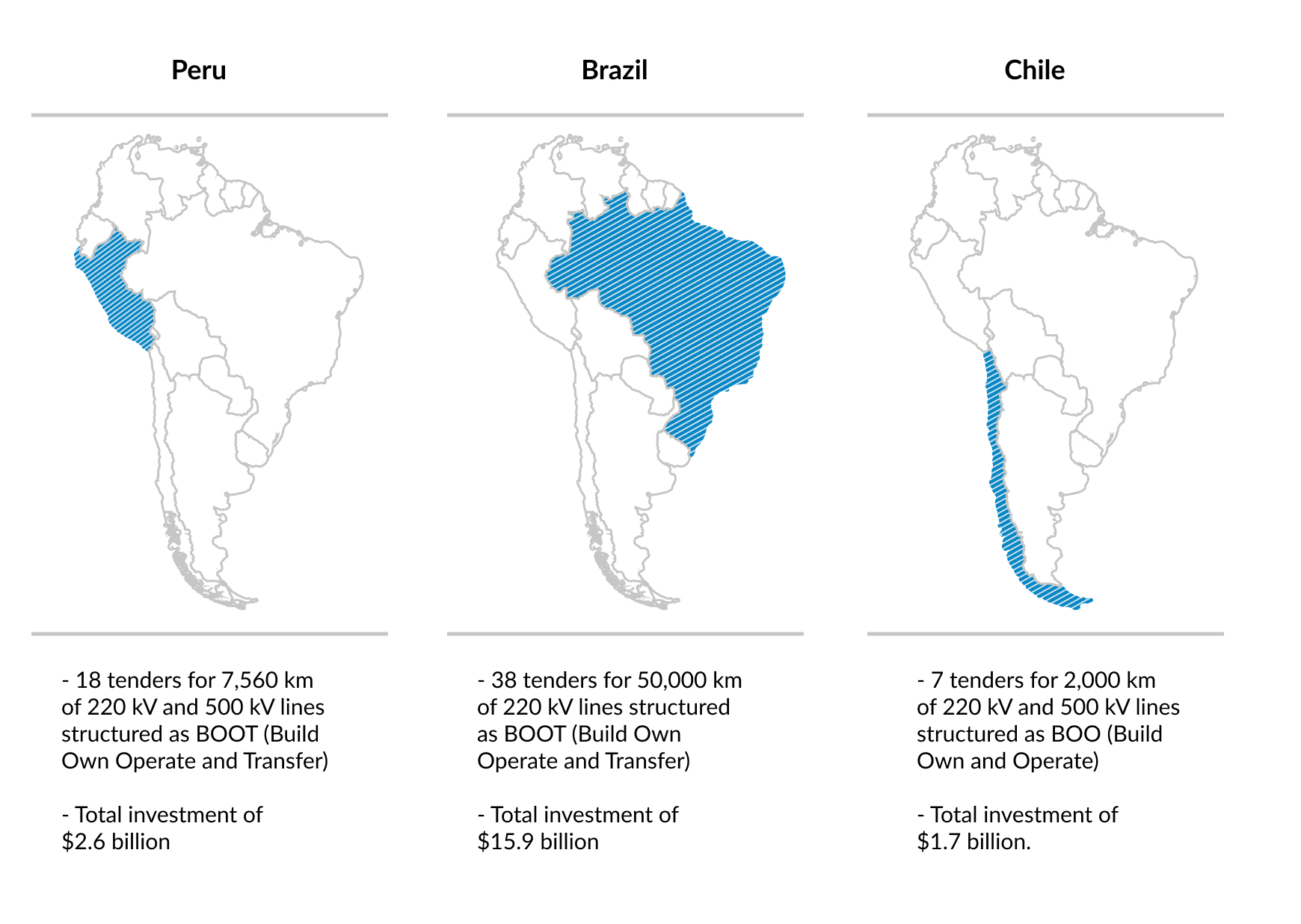

As previously noted, the existing transmission gap in Sub-Saharan Africa is driven in large part by the inability to fund new infrastructure through public budgets or finance public infrastructure due to a history of operating losses. Thus, the first motivating factor for using private capital to fund transmission infrastructure is to mobilise finance over and above what the public sector may be able to provide. The private sector is not, however, simply a source of capital. It is also a partner in project management, cost control and risk mitigation. With the appropriate set of incentives, the private sector can be an extremely efficient implementation model for transmission projects at a low cost and on schedule. Successful private transmission projects have been implemented in India, Latin America, the Philippines, United Kingdom, and elsewhere. Brazil alone has financed over 50,000 km of transmission lines through private investments.

Inviting private investment in the transmission sector can also bring innovation through the utilisation of state-of-the-art technologies which are transforming the energy landscape. For example, smart grid technologie introduce new capabilities and provide opportunities for more efficiency, as well as new services (energy management, distributed generation, internet and telecoms).

Increasing role of the private sector in transmission

While private investment is not as widespread in transmission as in power generation, there is substantial experience worldwide. In addition to well-functioning power markets in OECD countries (e.g., United Kingdom), private transmission has become common in the last twenty years across Latin America and in countries such as India, Kazakhstan, and the Philippines. Just in the period 2000-2015, multiple projects materialised in Latin America as summarised in Figure 1.2.

Similarly, India has developed more than 500 km of 400kV and 765kV lines through private investment. Kazakhstan has a privately owned and financed transmission system, and the Philippines privatised their existing transmission system through a 25-year concession in 2009.

Sub-Saharan Africa was able to leverage the experience from other markets to adopt new business models and avoid legacy infrastructure (for example, deploying wireless data/voice systems rather than installing landlines). In the same way, the African energy market can learn from the recent experience in peer markets around the world to move past the traditional focus of publicly financed transmission infrastructure and instead foster a dynamic market place that is driven by private investment.

A Guide to the Guide

Who is this book for?

This handbook would benefit all stakeholders involved in the power sector and more specifically in the development of transmission infrastructure. The book is intentionally designed to benefit all levels of readers:

Beginner: The book provides an overview of the fundamental regulatory structure of transmission markets, the planning and procurement of transmission systems and the core principles of contracting and finance that are required to attract private investment. The intent is that with this essential background information in mind, the detailed explanation of private investment models will be easier to understand.

Utility/Regulator: The observations and guidance in this handbook are presented from the perspective of a public official in an utility or a regulator. Specifically, the assumption is that such an official has already recognised the need to bring private-sector investment into the market. Further, the book assumes that the official is considering the required adjustments to the existing regulatory framework and the specific obligations in any partnership with a private-sector investor to develop transmission infrastructure.

Procuring Agency/Negotiator: Perhaps the greatest value that we can convey in this book is the collective experience of the authors in planning, procuring and negotiating transmission projects. As a result, the book contains significant detail on the structuring of private transmission projects, the allocation of risks and obligations within those structures, and related considerations around financing and regulatory compliance.

In addition to the public sector readers described above, this handbook should also be helpful to other sector participants including the transmission companies, transmission system operators, regulators, investors, and financial institutions as it presents a diverse set of considerations that those parties must address in their role in the development of private transmission projects.

Who are the authors?

The knowledge and guidance presented in this book are not intended to represent the opinion of any one author. As emphasised throughout this book, the development of transmission infrastructure through a partnership between the public and private sector requires close collaboration between stakeholders and the application of expertise from many disciplines. To hold to this guiding principle, the development of this handbook also brought together a diverse group of stakeholders and experts. Our group of authors, who each contributed their time on a pro-bono basis, includes contributors from governments, development banks, investment funds, project developers, universities and leading international law firms. Equally important is that our group includes engineers, economists, lawyers and regulators who collectively have over 200 years of experience in the energy sector. Our sincere hope is that the collective wisdom and dedication of this group demonstrates how important it is to make progress in addressing the infrastructure gap in Sub-Saharan Africa and that our contribution will make a meaningful impact on that effort.

How was this book developed?

The unique conditions for the preparation of this handbook are notable

since they differ from the rest of the Understanding series. As with previous books, this handbook was produced using

the

The authors would like to thank our Book Sprint facilitator Barbara Rühling for her ability to adapt the Book Sprint process to a virtual format and for her patient guidance throughout the hours of staring at our confused faces on a computer screen. The authors would also like to thank Henrik van Leeuwen and Lennart Wolfert for turning our rushed scribbles into beautiful and meaningful illustrations. The tireless work of Book Sprints’ remote staff Raewyn Whyte and Christine Davis (proofreaders), and Agathe Baëz (book design), should also be recognised. It is also important to recognise the considerable planning and development that went into the conceptualisation of this handbook before the drafting process. In particular, our deepest appreciation goes to Elizabeth Clinch (International Program Specialist, CLDP) for the original research at the outset of the concept development and for her tireless work to bring our group together in a virtual space. The authors would also like to recognise the following individuals and institutions that helped focus dialogue to build a consensus around the need for a handbook focused on transmission financing: Jennifer Baldwin (Power Africa); Megan Taylor (Power Africa); and Kenyon Weaver (Commercial Law Development Program). The authors would also like to thank the generous funding and logistics support from the United States Agency for International Development’s Power Africa programme and the African Legal Support Facility.

How may I use this book?

To continue the tradition of open-source knowledge sharing that is at the core of the Understanding series, both as a standalone reference guide and as a jumping-off point for further discussion and scholarship, the book is published under the Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License (CC BY NO SA). In selecting this publication license, the authors welcome anyone to copy, excerpt, rework, translate and/or re-use the text for any non-commercial purpose without seeking permission from the authors, so long as the resulting work is also issued under a Creative Commons License. The handbook is initially published in English with translated editions soon to follow. The handbook is available in electronic format at http://cldp.doc.gov/Understanding as well as in print format. Many of the contributing authors are also committed to working within their institutions to adapt this handbook for use as the basis for training courses and technical assistance initiatives.

How does this book relate to the Understanding Series?

This handbook is the fifth in the Understanding series published by Power Africa. The first handbook,

Gas and LNG Options

The Authors

|

Reason Abajuo Legal Counsel African Legal Support Facility |

Samson O. Masebinu Development Assistance Specialist: Energy Finance USAID/Power Africa (South Africa) |

|

Mohamed Rali Badissy Professor of Law Penn State Dickinson Law (USA) |

Subha Nagarajan Managing Director Global Capital Advisory (USA) |

|

Christopher Flavin Business Development Director Gridworks (UK) |

Gadi Taj Ndahumba African Legal Support Facility |

|

Jay Govender Projects and Energy Sector Head Cliffe Dekker Hofmeyr Inc. |

Kaushik Ray Partner Trinity International LLP (UK) |

|

Ryan Ketchum Partner Hunton Andrews Kurth LLP (UK) |

Stratos Tavoulareas Energy Advisor and Visiting Scholar George Washington University (USA) |

|

Julius Kwame Kpekpena Chief Operating Officer Millennium Development Authority (Ghana) |

Omar Vajeth Principal Corporate Relations Officer African Development Bank |

|

Mohammed Loraoui Attorney Advisor (International) U.S. Department of Commerce (USA) |